Affordable Financial Management That Scales As Your Business Grows

Bookkeeping, Accounting & CFO Services for US Businesses

Investors Require Accurate And Timely Reporting. We Make Sure Yours Impress.

- Save 40-60% vs. hiring in-house

- Full-spectrum finance support from bookkeeping to CFO

- Trusted vendor network: insurance, legal, and compliance

- Fast onboarding — up and running in 3 – 5 days

Accounts Payable & Receivable

Accounts Payable & Receivable

Reporting – On-time, Investor-Friendly Financials

Reporting – On-time, Investor-Friendly Financials KPIs & Metrics – Custom Dashboards That Drive Decisions

KPIs & Metrics – Custom Dashboards That Drive Decisions Budgeting – Aligned to Your Growth Goals

Budgeting – Aligned to Your Growth Goals Forecasting – Predict Future Revenue & Expenses

Forecasting – Predict Future Revenue & Expenses Hiring & Resource Planning – Strategic Headcount Roadmap

Hiring & Resource Planning – Strategic Headcount Roadmap Consolidation – Unified View Across Entities & Accounts

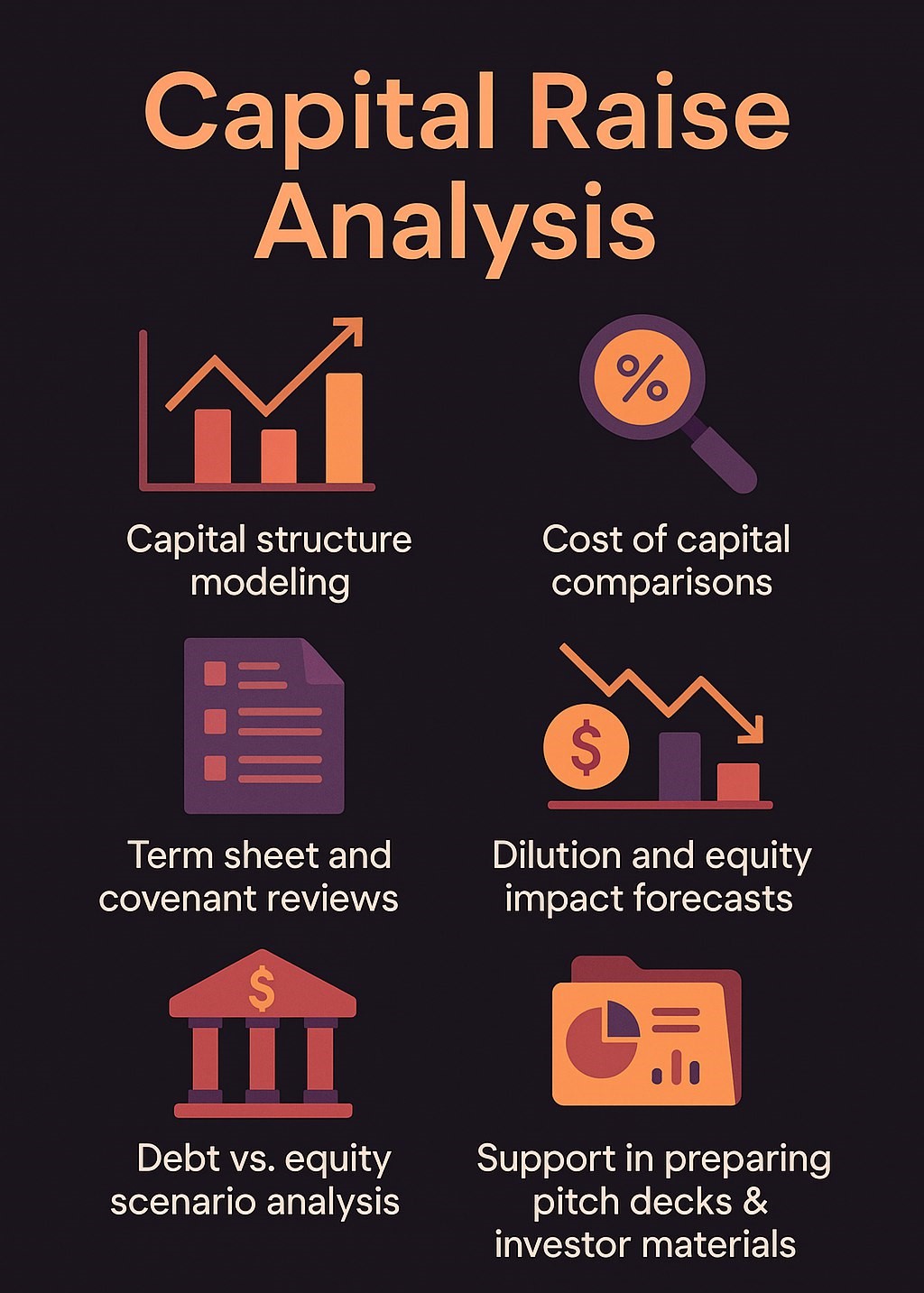

Consolidation – Unified View Across Entities & Accounts Capital Structure Modeling

Capital Structure Modeling Cost of Capital Comparisons

Cost of Capital Comparisons Term Sheet and Covenant Reviews

Term Sheet and Covenant Reviews Dilution and Equity Impact Forecasts

Dilution and Equity Impact Forecasts Debt vs. Equity Scenario Analysis

Debt vs. Equity Scenario Analysis Support in Preparing Pitch Decks & Investor Materials

Support in Preparing Pitch Decks & Investor Materials